Will There Be A Tax Credit For Electric Cars In 2020

Leases do not qualify however since the manufacturer receives the tax credit. The amount of credit you are entitled to depends on the battery capacity and size of the vehicle.

/cdn.vox-cdn.com/uploads/chorus_asset/file/21903701/akrales_200915_4161_0008.0.jpg)

Volkswagen Introduces Id 4 Electric Suv With 250 Miles Of Range And A 40 000 Price Tag The Verge

On October 1 2019 the credit will be reduced to 1875 for the next two quarters.

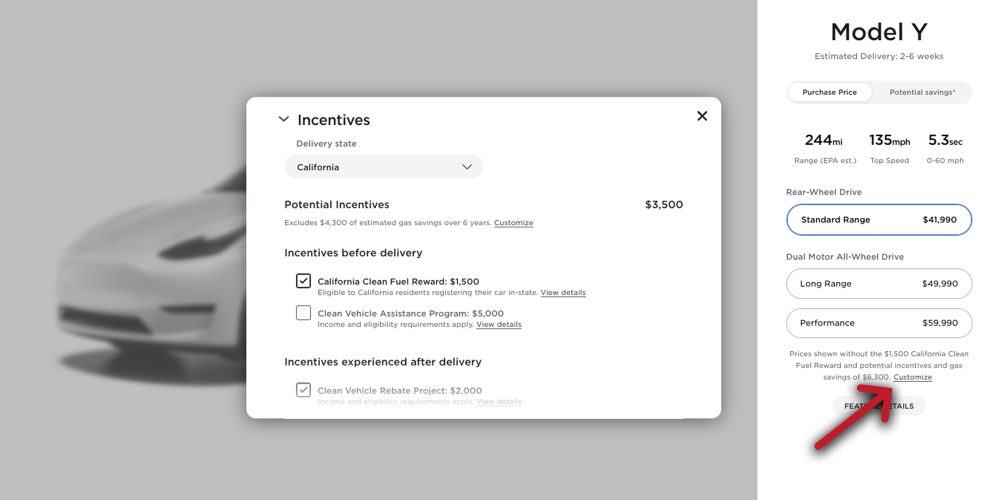

Will there be a tax credit for electric cars in 2020. Electric cars are entitled to a tax credit if they qualify. Visit FuelEconomygov for an insight into the types of tax credit available for specific models. For the next six months the cars were eligible for a 3750 credit which was then tapered down to 1875.

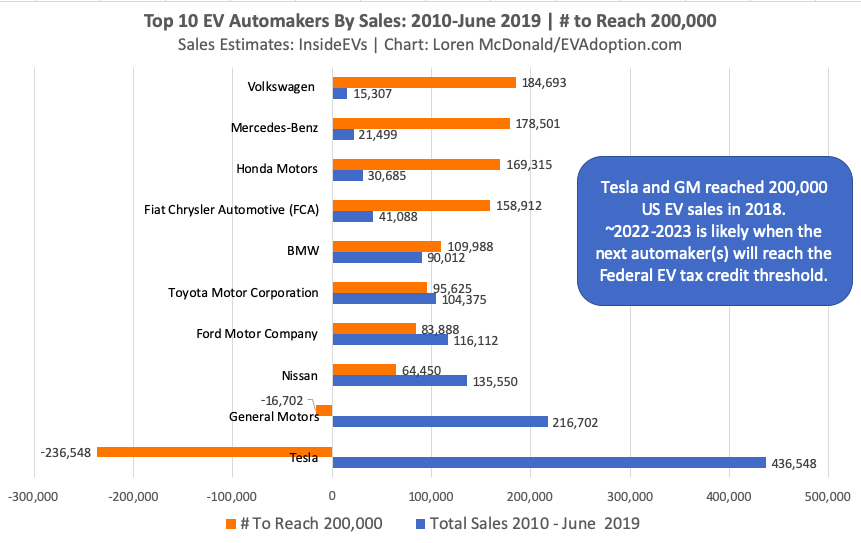

While that doesnt translate into direct savings off the purchase price you may get some delayed gratification after April 15. General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018. All EVs receive a 7500 credit with an.

The plug-in electric drive motor vehicle credit was enacted in the Energy Improvement and Extension Act of 2008 and subsequently modified in later law. A buyer of a new electric car can receive a tax credit valued at between 2500 and 7500. December 1 2020 - To get the federal EV tax credit you have to buy a new and eligible electric car.

The vehicle must include at least 5. After July 1 st until the end of the year the credit is only worth 1875. You may also be able to amend a tax return to claim credit if you purchased it in a previous year and owed taxes.

If your purchased an electric or alternative motor vehicle in 2020 you may be able to claim credit on your 2020 Tax Return. From April 2019 qualifying vehicles are only worth 3750 in tax credits. A new bill to reform the federal electric car tax incentive in the US has passed the US Senate Finance Committee.

In short automakers that have met the threshold already would have access to a new 7000 tax credit for 400000 additional electric vehicles until a new phase-out period starts again. The value of the IRS tax credit ranges from 2500 to 7500 depending on the electric vehicle in question. However a few qualify for the full federal EV tax credit including.

The value of the IRS tax credit ranges from 2500 to 7500 depending on the electric vehicle i. According to the EPA the credit begins to phase out for vehicles the second quarter after the manufacturer has. GM would be the big winner with the updated regulations while Tesla would again receive some federal tax credits.

GMs EVs and hybrids qualified for the full 7500 federal tax credit until Mar. EV tax credits jump to 12500 in latest legislation -- with a catch. This credit is nonrefundable and will only offset your tax liability for a given tax year.

From 2020 you wont be able to claim tax credits on a Tesla. Among other things the proposal increases the maximum tax credit for an electric car to 12500 though there are several tiers to this. Here are the currently available eligible vehicles.

Since it is a tax credit you do not get it immediately upon purchasing the EV. 2020 Chrysler Pacifica Hybrid. If you purchased a hybrid motor vehicle in 2020 you may be able to claim credit on your 2020 Tax Return.

2018 2019 2020 2021 available Cars credit Electric tax. You apply for the EV federal tax credit when you file your taxes for the year you purchased the vehicle. It includes increasing the electric vehicle tax credit to up to 12500 but it.

Yes the electric vehicle tax credit is available for some but not all automakers. 2020 and 2021 Toyota Rav4 Prime. After March 31 2020 no credit will be available.

This credit is nonrefundable and will only offset your tax liability for a given tax year. When you buy an electric or plug-in hybrid vehicle you may qualify for a federal tax credit that reduces your income tax liability. It provides a credit for eligible passenger vehicles and.

Electric cars are entitled to a tax credit if they qualify. Every vehicle with a plug earns a minimum of 2500 from the EV tax credit -- that includes a plug-in hybrid not just a totally battery-electric vehicle. If you purchased a new EV in.

You may also be able to amend a tax return to claim credit if you purchased it in a previous year and owed taxes. 2020 Honda Clarity PHEV. 343 Zeilen General Motors vehicles purchased after 3312020 are not eligible for these tax credits.

How to Claim the EV Federal Tax Credit. Size and battery capacity are the.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How Do Electric Car Tax Credits Work Credit Karma

Electric Vehicle Tax Credits What You Need To Know Edmunds

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Https Fas Org Sgp Crs Misc If11017 Pdf

How Do Electric Car Tax Credits Work Kelley Blue Book

Electric Car Tax Credits What S Available Energysage

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired

Why Electric Cars Are Only As Clean As Their Power Supply Electric Hybrid And Low Emission Cars The Guardian

Electric Car Tax Incentives And Rebates Reliant Energy

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Electric Vehicle Tax Credits What You Need To Know Edmunds

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Ev Tax Credits Could Expand To Used Car Purchases What To Know Roadshow

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Post a Comment for "Will There Be A Tax Credit For Electric Cars In 2020"